Learn to trade the smart way!

Execution Desk

Providing a systematic, rules-based approach to understanding market structure, execution, and risk. No signals. No hype. Just frameworks that work across market conditions.

YOUR TRADING JOURNEY STARTS HERE

WHO IS EXECUTION DESK FOR

Execution Desk is built for traders who want a rules-based approach rather than opinions, who prefer structure over prediction, and who understand that risk management matters more than entries. It is designed for those trading FX, indices, or metals, and for traders who are tired of contradictory strategies, constant noise, and approaches that change with every market move.

WHAT WE FOCUS ON

Execution Desk focuses on understanding market structure by teaching how price moves, how trends form, and how ranges develop over time. It emphasises execution logic, where entries, stops, and targets are designed around clear rules and reasoning rather than hope or emotion. All frameworks are built for repeatability, allowing traders to apply the same structured approach consistently instead of reinventing their strategy every week.

HOW EXECUTION DESK WORKS

Execution Desk teaches traders to first understand market structure by learning how price behaves across different timeframes and market conditions. From there, the framework is applied using rules-based execution and risk models that remove emotional decision-making. This process is supported by practical tools such as calculators, templates, and checklists, all designed to reinforce consistency and disciplined execution.

Education that Builds Trading Discipline

Execution Desk exists to explain how markets truly operate, how trading decisions can be made through logic rather than emotion, and why execution and risk management are more important than chasing signals.

📌 Framework Learning We begin with how price structures itself over time — trending phases, range behaviour, and time frame context — so you see where the market truly is, not where you wish it was.

🔧 Tools & Templates Download calculators, trade planners, and checklist templates that enforce structure and reduce mistakes before execution. These are practical, not decorative.

📈 Self-Paced Courses From fundamentals to repeatable systems, our structured courses focus on process and discipline — not fast riches nor noise.

TRADE WITH STRUCTURE

EXECUTION DESK

Execution Desk is an independent trading education platform focused on market structure, execution logic, and risk management. We help self-directed traders understand how markets actually function and how decisions can be made with discipline, clarity, and consistency.

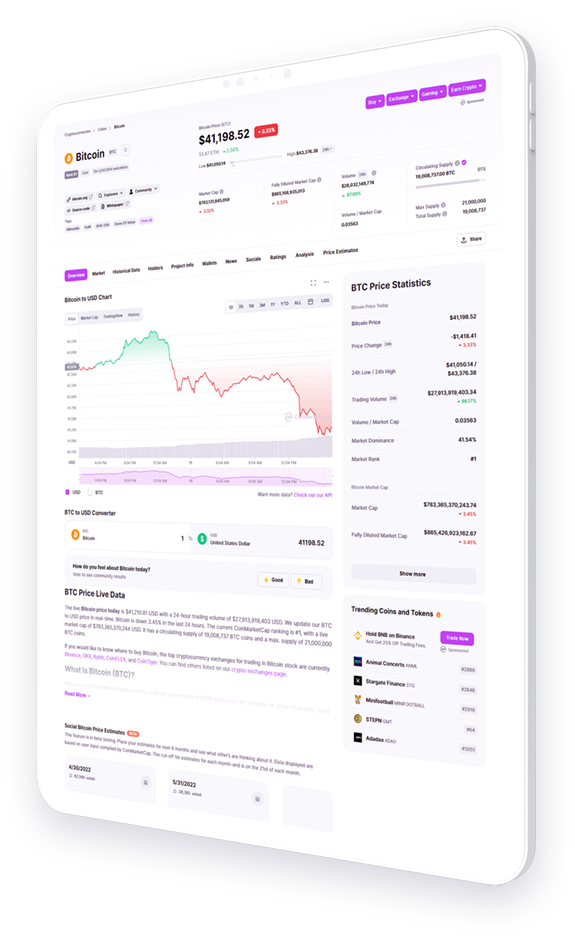

BROKERS

Execution quality — spreads, slippage, platform stability — affects results just as much as decision logic. Poor infrastructure can undermine a disciplined system. Execution Desk helps you understand what to evaluate in a broker, why it matters, and how to do it.

GET THE STARTER GUIDE

Get the Execution Desk Starter Guide to begin building a structured, rules-based approach to your trading decisions. This guide introduces the core principles of market structure, execution logic, and risk control, helping you move away from reactive, noise-driven trading and toward deliberate, repeatable decision-making.

Market Structure

Risk Control

Execution Logic

Trade Reviews

DISCLAIMER

Execution Desk provides education only. This site does not offer financial advice, signals, or managed accounts. Trading involves risk, and loss is possible. Always evaluate infrastructure and risk management before applying any framework.